The Charleston Principles

It is important to note that the Charleston Principles are merely guidelines. It is an effort by the National Association of State Charity Officials (NASCO) to provide jurisdictions with guidelines on regulating online fundraising. If you intend to solicit donations in any state that has charitable registration statutes, you must comply with state-specific statutes.

Most charitable organizations offer valuable services not provided by government or the private sector. However, deceptive solicitations, including fraud and misuse of charitable contributions, pose significant problems. Reasonable state oversight of charitable organizations and professional fundraisers can reduce such abuses, supporting those who provide essential services and educating donors. Registration and financial reporting are crucial for increasing donor confidence and aiding law enforcement in combating deception and misuse of contributions.

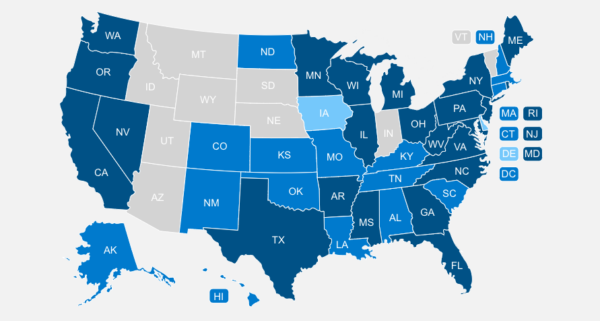

Current registration statutes typically cover Internet solicitations alongside traditional fundraising methods like telephone, direct mail, and face-to-face appeals. Yet, the rise of website solicitations prompts questions about registration requirements.

State charity officials often gain insights when consulting with the regulated communities. Therefore, consistent guidelines for online charitable solicitations will help state officials, donors, charities, and online entrepreneurs nationwide. These Principles, adopted to encourage creative and responsible online charitable activities, were discussed at the National Association of Attorneys General/National Association of State Charity Officials (NAAG/NASCO) Conference in Charleston, South Carolina, in October 1999, initiating a dialogue on internet solicitations.

General Principles

These Principles guide states on when charities and their fundraisers may need to register or face enforcement action for online charitable solicitations. States are encouraged to adapt these Principles to align with their laws. However, these Principles neither represent the views of any specific entity nor an official NASCO policy. They acknowledge the variation in state laws and the potential for different implementation strategies.

The core idea here is that while state laws apply to online charitable solicitations, the Internet presents new challenges for state charity officials in fulfilling their roles. Thus, they should require registration from entities within their jurisdiction to enforce registration requirements. In cases of deceptive practices, including fraud and misuse of funds, jurisdiction often extends to some organizations not mandated to register in the state.

These Principles don't limit jurisdiction under common law. The traditional jurisdiction analysis remains the standard for states.

Actions to Enforce State Laws Against Charitable Solicitation Fraud

States will enforce the law against any entity whose Internet solicitations mislead or defraud persons physically located within a particular state, without regard to whether that entity is domiciled in the state or is required to register in that state pursuant to these Principles.

Application of Registration Requirements to Internet Solicitation

A. Entities That Are Domiciled Within the State

-

An entity that is domiciled within a state and uses the Internet to conduct charitable solicitations in that state must register in that state. This is true without regard to whether the Internet solicitation methods it uses are passive or interactive, maintained by itself or another entity with which it contracts, or whether it conducts solicitations in any other manner.

-

An entity is domiciled within a particular state if its principal place of business is in that state.

B. Entities That Are Domiciled Outside the State

- An entity that is not domiciled within a state must register in accordance with the law of that state if:

- Its non-Internet activities alone would be sufficient to require registration;

- (1) The entity solicits contributions through an interactive Web site; and

- Either the entity:

- Specifically targets persons physically located in the state for solicitation, or

- Receives contributions from the state on a repeated and ongoing basis or a substantial basis through its Web site.; or

- (1) The entity solicits contributions through a site that is not interactive, but either specifically invites further offline activity to complete a contribution, or establishes other contacts with that state, such as sending e-mail messages or other communications that promote the Web site; and

- (2) The entity satisfies Principle III(B)(1)(b)(2).

- For purposes of these Principles, each of the following terms shall have the following meanings:

- An interactive Web site is a Web site that permits a contributor to make a contribution, or purchase a product in connection with a charitable solicitation, by electronically completing the transaction, such as by submitting credit card information or authorizing an electronic funds transfer. Interactive sites include sites through which a donor may complete a transaction online through any online mechanism processing a financial transaction even if completion requires the use of linked or redirected sites. A Web site is interactive if it has this capacity, regardless of whether donors actually use it.

- To specifically target persons physically located in the state for solicitation means to either

- (i) include on its Web site an express or implied reference to soliciting contributions from that state; or

- (ii) to otherwise affirmatively appeal to residents of the state, such as by advertising or sending messages to persons located in the state (electronically or otherwise) when the entity knows or reasonably should know the recipient is physically located in the state. Charities operating on a purely local basis, or within a limited geographic area, do not target states outside their operating area, if their Web site makes clear in context that their fundraising focus is limited to that area even if they receive contributions from outside that area on less than a repeated and ongoing basis or on a substantial basis.

- To receive contributions from the state on a repeated and ongoing basis or a substantial basis means receiving contributions within the entity’s fiscal year, or relevant portion of a fiscal year, that are of sufficient volume to establish the regular or significant (as opposed to rare, isolated, or insubstantial) nature of those contributions. States should set, and communicate to the regulated entities, numerical levels at which it will regard this criterion as satisfied. Such numerical levels should define ‘repeated and ongoing’ in terms of a number of contributors and ‘substantial’ in terms of a total dollar amount of contributions or percentage of total contributions received by or on behalf of the charity. Meeting any threshold would give rise to a registration requirement but would not limit an enforcement action for deceptive solicitations. For example, a state might explain that an entity receives contributions on a repeated and ongoing basis if it receives at least one hundred online contributions at any time in a year and that it receives substantial contributions if it receives $25,000, or a stated percentage of its total contributions, in online contributions in a year.

- An entity that solicits via e-mail into a particular state shall be treated the same as one that solicits via telephone or direct mail, if the soliciting party knew or reasonably should have known that the recipient was a resident of or was physically located in that state.

- Questions may arise as to whether individual charities are required to register in a particular state when the operator of a Web site through which contributions for that charity are solicited or received is required to register, but the charity itself would not independently satisfy the criteria of Principle III(B)(1)(b). As to such charities:

- If the law of the state does not universally require the registration of all charities on whose behalf contributions are solicited or received through a commercial fundraiser, commercial co-venturer, or fundraising counsel who is required to register, then states should independently apply the criteria of Principle III(B)(1)(b) to each charity and require registration only by charities that independently meet those tests; but

- If the law of the state universally requires registration of all charities under such circumstances, states should consider whether, as a matter of prosecutorial discretion, public policy, and the prioritized use of limited resources, it would take action to enforce registration requirements as to charities who do not independently meet the criteria of Principle III(B)(1)(b); and

- For purposes of this Principle, a charity satisfies the interactivity criterion of Principle III(B)(1)(b)(i) if (i) any Web site through which contributions are solicited or received for that charity satisfies that requirement, and (ii) that Web site is operated by an entity with whom the charity contracts. This paragraph does not define the concept of interactivity, but merely addresses the application of that concept in this specific context.

- Solicitations for the sale of a product or service that include a representation that some portion of the price shall be devoted to a charitable organization or charitable purpose (often referred to as ‘commercial coventuring’ or ’cause marketing’) shall be governed by the same standards as otherwise set out in these Principles governing charitable solicitations. Registration is therefore required in those states that require registration for such activities, by charitable organizations and their internal fundraisers, their external commercial fundraisers as applicable.

C. General Exclusions from Registration

- Maintaining or operating a Web site that does not contain a solicitation of contributions but merely provides program services via the Internet — such as through a public information Web site — does not, by itself, invoke a registration requirement. This is true even if unsolicited donations are received.

- Entities that provide solely administrative, supportive or technical services to charities without providing substantive content, or advice concerning substantive content, are not required to register. Such service providers (a) include Internet service providers and entities that do nothing more than process online transactions for a separate firm that operates a Web site or provide similar services, but (b) do not include commercial fundraisers, commercial co-venturers, or fundraising counsel. Administrative, supportive, or technical service providers may be required to register if they do more than simply provide such technical services and actually solicit, promote a Web site or engage in other conduct that requires registration. Compensation for services based on the amount of funds raised may be a strong indication the entity is doing more than simply providing technical services.

Principles Related to Minimizing Regulatory Responsibilities for Multi-State Filers

- State charity officials recognize that the burden of compliance by charitable organizations and their agents, professional fundraisers, commercial co-venturers and/or professional fundraising counsel should be kept reasonable in relation to the benefits to the public achieved by registration. The acceptance and use of the Unified Registration Statement for charitable organizations by state charity offices and the development and acceptance of other related projects to create such common forms are strongly encouraged.

- State charity officials recognize the power of the Internet to assist in the registration of charitable organizations and their agents. State charity offices are strongly encouraged to publish their registration and reporting forms, their laws and regulations and other related information on the Internet to facilitate registration and reporting by charitable organizations and their agents while assuring proper public accountability by regulated entities.

- State charity officials, charitable organizations and their agents, professional fundraisers, commercial co-venturers, and/or professional fundraising counsel have a mutual interest in exploring how to develop the information technology infrastructure so that registration and reporting can be accomplished electronically in the future. Collaboration on this project between state charity officials and these entities, where appropriate, will advance the timeframe for establishing electronic filing. This collaboration may include discussion of the types of information that entities soliciting through the Internet should be required to retain, so that these Principles can be applied to a particular Web site. This would include information sufficient to determine, within the scope of the law and relevant donor privacy concerns, whether an entity’s ties to a particular state are sufficient to give rise to a registration requirement.

- Because disclosure to the public promotes informed giving, charitable organizations are encouraged to satisfy the IRS ‘widely available’ standard by posting, without charge, their current Unified Registration Statement, their last three IRS Forms 990, and their complete IRS Form 1023 or 1024 application and resulting determination letter on their Web pages. Links to other sites that provide such information, including any relevant state agency, or other Web sites, are also encouraged. Such postings, however, do not currently fulfill any applicable registration requirements.