A BREAKDOWN OF THE CARES ACT FOR NONPROFIT ORGANIZATIONS

April 3, 2020

Please Help Your Local Food Bank

April 17, 2020THE IRS EXTENDS FILING DEADLINES FOR NONPROFIT ORGANIZATIONS

THE IRS EXTENDS FILING DEADLINES FOR NONPROFIT ORGANIZATIONS

To further provide aid to nonprofit organizations and foundations, amid the COVID-19 pandemic, the IRS released Notice 2020-23 on Thursday the 9th of April, extending due dates for Form 990 filings. Nonprofit organizations that previously had deadlines of April 1st to July 14th, 2020, now have until July 15 to file.

Due to the special circumstances, your nonprofit is not required to file for an extension. The extension is available automatically. However, if your organization needs more time, you are required to file for an extension.

The automatic extension includes:

- Forms 990, 990-EZ, 990-N and 990-PF

- Form 5227 required of charitable remainder trusts and charitable lead trusts

- Form 1041 required of charitable lead trusts

- Forms 5500 and 5500-EZ required of employee benefit plans

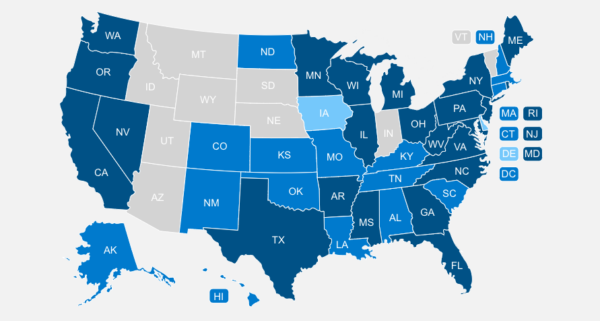

At the state level, while some states such as Illinois base their due dates on IRS due dates, meaning that their due dates are automatically extended along with the IRS extended due dates. This is a developing situation, as such, it is still early to know if other states will also allow for an extension.

The address to mail your Form 990 to is:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0027

If the charity is overseas, they have a separate address to mail to which is:

Department of the Treasury

Internal Revenue Service Center

P.O. Box 409101

Ogden, UT 84409

Note that per the Taxpayer First Act Law (H.R. 3151), the IRS has expanded mandatory electronic filings for nonprofit tax returns. Mandatory filings will go into effect for most nonprofits in 2021 and to all by 2022

If your nonprofit needs to file an IRS Form 990, we can help. While Labyrinth does not provide this service, we have a network of partners who can help you with the preparation and filing of your IRS Form 990. Contact us now to be connected with one of our partners.

Trust the #1 Choice

for State Charitable Registration

More nonprofits choose Labyrinth

than any other service provider

Contact Us Today

Want To Learn More?

Join Our Monthly Webinar

Charitable Registration: How Can I Be Compliant?

Read Our Whitepaper

Charitable Registration: Navigating The Complexities

We proudly provide

compliance services for: