Starting a Charity: Expectations vs Reality

July 18, 2019

Maintaining Fundraising Momentum

October 1, 2019Workplace Giving Campaign

WORKPLACE GIVING

Workplace giving is an easy and efficient way for employees to make tax-deductible contributions to charitable causes that align with their personal values. Workplace giving accounts for close to $5 billion annually in charitable donations and is projected to grow as more and more companies are realizing the value workplace giving programs can have on employee engagement and morale.

From the perspective of the company sponsoring the program, it can be an efficient way to help optimize corporate social responsibility. For participating charities, it is a cost-effective means to generate additional funds, as it bypasses the need and costs of fundraising.

Workplace giving campaigns can be conducted through several means, the most common of which are employer-sponsored programs that give employees the option to make donations to a charity of their choosing through payroll deduction.

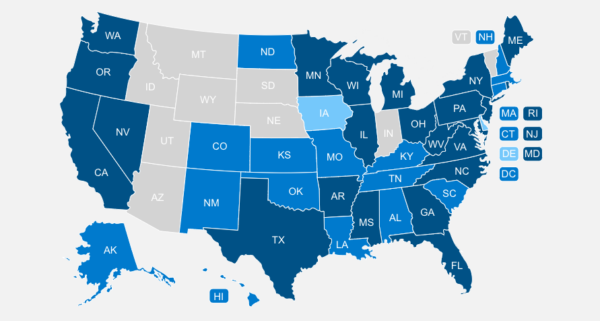

Workplace giving can be can be delineated into Private Sector Campaigns, State Employee Campaigns and the Combined Federal Campaign.

Private Sector Campaigns

These are workplace giving campaigns conducted by private organizations. They can take several forms which include:

- Payroll Deduction Donations: Employees donate to a worthy cause by deducting an agreed upon amount from their paychecks.

- One-Time Gift: Cut a check or offer cash directly.

- Employee Matching Donations: Employers make a donation to match or double charitable contributions from its employees.

- Employee Volunteer Campaigns: Encourages employees to give a gift of themselves or their time to help further a cause in their community.

- Disaster Relief Grants: Corporations provide grants and matching gifts to support areas or countries impacted by natural disasters. These grants can come straight from the corporation or the corporation could match donations from either employees or customers.

Private sector campaigns are either organized by the employer or the employer may enlist the services of the following charitable organizations who focus on connecting employees to charities: United Way, Earthshare, Global Impact, America’s Charities or Community Health Charities.

State Employee Campaigns (SEC) or State Employee Combined Campaigns (SECC)

These are workplace giving campaigns conducted by the state or local public sectors that involves state employees contributing to causes of their choosing. State Employee Campaigns are conducted once a year. How and when differs from state to state and municipality to municipality. For example, in California, the campaign begins in October and is completed by December 15. A payroll deduction pledge form is given to each state employee to fill out and return by December 15 to be submitted to the State Controller’s Office for processing.

State Employee Combined Campaigns are governed at both the state and local level, ensuring that the program is equitable and fair under strict guidelines which give donors confidence in both the charities that benefit and the methodology used to raise funds.

One of the advantages of SECC is the wide variety of charities to select from. They range from small local organizations to national and even international organizations. There is an option for every donor.

Combined Federal Campaigns (CFC)

The federal government workplace giving campaign is designed for federal employees to donate to their charity of choice. With over 20,000 charitable organizations in participation, CFC is the largest fundraising drive in the world.

CFC’s are managed by federal employee volunteers who work with experienced nonprofit executives to generate funds and distribute them to participating charities accordingly. This partnership is strategic in the sense that it gives Federal employees an opportunity to get involved in the bettering of lives and the preservation of our planet while also helping participating local and national nonprofits raise funds.

Eligibility

Across all platforms, for a charity to be eligible to be included in a workplace giving campaign, it must adhere to certain guidelines and minimum requirements. Eligibility standards typically address fiscal accountability, governance and programmatic impact. While eligibility standards vary, the most common ones include:

- Participating charities must be recognized by the IRS as a 501(c)(3) nonprofit organization, and must be registered with their Secretary of State.

- The charity should adhere to specific and often generally-accepted auditing standards.

- They spend below a percentage of funds raised on administrative and overhead costs.

Bottom line is that from Private Sector Campaigns, State Employee Campaigns and Combined Federal Campaigns accord participating charities a wider access to potential donors. 20,000 employees, contributing $1.00 per paycheck in 26 pay periods generates $520,000 per year. Not only are workplace giving campaigns a cost effective funding source for nonprofits, they give a wider access to potential donors, and demonstrate the power of linking nonprofits to employees who want to give back.

Written by Franklin Asongwe