Charitable Solicitation Registration: A Compliance Guide

March 22, 2021

The Unified Registration Statement (URS): Is it Useful?

April 8, 20215 Nonprofit Fundraising & Other Legal Requirements to Know

Fundraising legal requirements are a complex but mission-critical part of running an effective nonprofit organization.

After all, federal and state-level regulations are what ultimately allow nonprofits to raise funds and reinvest their proceeds into their missions rather than losing a portion to taxes. Complying with these regulations shows the government (and donors) that your organization truly uses donations for their intended purposes and that you don’t abuse the goodwill of your generous supporters. Failing to comply with applicable fundraising requirements, even accidentally, can result in substantial penalties and the loss of your donors’ trust. It definitely pays to understand the fundraising legal landscape and seek help from professionals when needed.

For more than 30 years, the experts here at Labyrinth have worked with thousands of organizations to help them remain compliant with all state and federal fundraising legal requirements. We file tens of thousands of charity registrations each year, so we’re fully immersed in the world of fundraising law. We’ve rounded up the most essential regulations that every nonprofit operating in the United States should know. We’ll cover fundraising legal requirements that fall into these key categories:

- Charitable Solicitations

- Tax-Deductible Charitable Contributions

- Requirements for Tax Exemption

- Requirements for Fundraising Events

- Requirements Regarding Email

Compliance starts with understanding the range of requirements that your nonprofit is held to. Starting with these essentials will set your organization up for continued success without the worry of legal penalties and fines slowing down your mission. With that foundation in place, you can then dig deeper into your unique regulatory context with confidence. Let’s get started.

Fundraising Law Concerning Charitable Solicitations

Laws surrounding charitable solicitations give the government transparency into the fundraising activities of nonprofit organizations. These regulations are intended to protect donors and assure them that their gifts are going towards reputable organizations.

By securing 501(c)(3) status from the IRS, your nonprofit becomes a recognized fundraising organization at the federal level. However, charitable solicitations themselves are regulated at the state level. This means that you must register to fundraise in the state jurisdictions where your nonprofit actively solicits donations. This process is referred to as charitable solicitation registration or fundraising registration, and it’s typically handled through each state’s Attorney General or Secretary of State office.

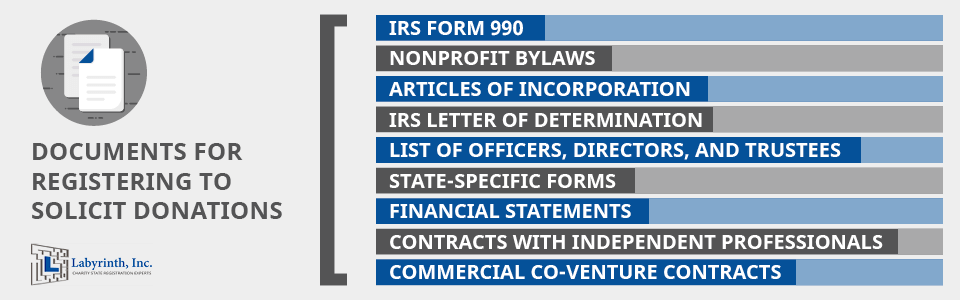

Each state may require a different set of documents in order to register for charitable solicitations, but there are a few common pieces of documentation that you should be prepared to provide. These can include:

- Your IRS Form 990

- A copy of your nonprofit’s bylaws

- A copy of your articles of incorporation

- Your IRS Letter of Determination

- Lists of your officers, directors, and trustees

- Any other forms that the state specifically requests

- Reviewed financial statements

- Contracts with independent fundraising professionals, if applicable

- Contracts for commercial co-ventures, if applicable

In addition to these common types of documentation required for state charity registration, you should also keep fees, penalties, and renewal requirements in mind. Initial filing fees vary by jurisdiction, and many states require renewal fees, as well. In most states, nonprofits must renew their charitable solicitation registration each year, although there are two exceptions that operate on longer timeframes and only require registration every two years. Penalties for failing to register or renewing past the relevant deadline can include late fees and, in some cases, civil or criminal charges. Explore our guide to charitable solicitation registration for a complete breakdown of these requirements and frequently asked questions about state registration.

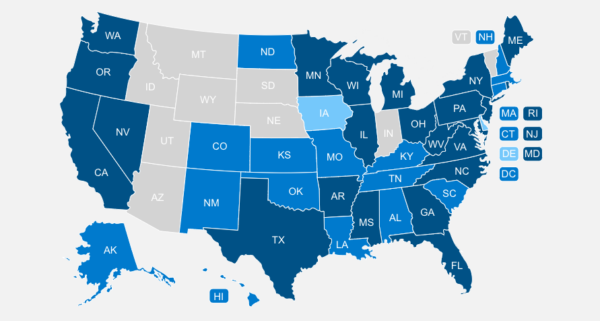

Most states require registration before your organization can begin actively soliciting donations from their residents. A handful of states don’t require registration, but they might have varying requirements for different types of nonprofits, so always take the time to double-check. Our directory of state fundraising registration requirements rounds up the relevant requirements for each state, so we recommend using it to start your research.

Online Fundraising Legal Requirements

The rise of the internet as a primary outlet for fundraising has created a new range of compliance challenges, so state registration requirements can also apply to online fundraising in different ways. With the ability to easily solicit donations from supporters across the country through donation pages, peer-to-peer campaigns, and email (more on this below), how do you know where to register your nonprofit in order to stay compliant?

Simply put, if you give residents of any US state the opportunity to donate to your nonprofit, you likely need to register to solicit donations in that state. Some states do explicitly require nonprofits to register if they accept donations from their residents online, but the regulatory landscape is extremely diverse. Most jurisdictions do not have specific laws pertaining to charity registration for online fundraising and instead group these activities under the broad category of solicitation through “other media.”

State-level laws and procedures for online fundraising regulation change constantly, so the safest choice is typically to register in all jurisdictions where registration requirements exist.

However, these filing expenses can easily become overwhelming for smaller organizations, so a more targeted approach may be necessary. In this case, some organizations choose to contain their risk by clearly stating on their main donation page or campaign donation pages which jurisdictions they can accept donations from. Additionally, peer-to-peer fundraising, in which your donors promote your campaign on your behalf, generally does not trigger a registration requirement, although the exact regulations can still vary by state. Always double-check your requirements or consult with compliance experts if you’re unsure of the exact specifications that you might be held to.

[maxbutton id=”1″ url=”/” text=”Learn how Labyrinth takes the guesswork out of state charity registrations.” ]

Nonprofit Fundraising Rules Related to Deductible Charitable Contributions

The biggest benefits of receiving official 501(c)(3) status from the IRS are tax exemptions for your nonprofit and the ability for your donors to deduct their contributions from their own taxes. For your donors to claim their contributions on their tax returns, your organization needs to be recognized as a qualified charity and actively maintain its 501(c)(3) status.

Even as tax laws evolve over time, nonprofits’ roles in the personal tax deduction process are limited. For instance, although the 2018 Tax Cuts and Jobs Act enables taxpayers to deduct more of their adjusted gross income through charitable donations, it does require that personal deductions be fully itemized. This has essentially reduced the number of taxpayers who are eligible for full personal deductions. Ultimately, donors and their tax advisers must navigate this process on their own. While you may not want to broadly announce to all of your donors that their gifts are tax-deductible (since this may not be true for every individual), you must still fulfill your nonprofit’s main responsibility—providing the proper documentation through donation receipts.

Requirements for Donation Receipts

Donation receipts are documents provided to donors that verify their gifts made to recognized 501(c)(3) nonprofit organizations.

Donation receipts are technically not required for every gift that you receive. In the US, explicit written acknowledgments or receipts are only required for individual contributions over $250. However, it’s best practice to always provide donors with receipts or other written acknowledgments of their gifts regardless of the size of their donations. This simple act of recognition shows your gratitude, helps to build trust with your supporters, and demonstrates that your nonprofit has its act together.

What information should a receipt contain? A complete donation receipt should include these essentials:

- Your organization’s name

- The donor’s name and date received

- Cash contribution amount

- Descriptions of non-cash contributions, if applicable

- A statement that no goods or services were provided by the organization in exchange for the donation, if applicable

- A description and estimate of the value of any goods or services that were provided in exchange for the donation, if applicable

- A statement that any goods or services provided in exchange for the donation consisted entirely of intangible religious benefits, if applicable for faith-based organizations

Considering the value of building trust through acknowledgment and the ease of sending thank-you notes and receipts via email, there’s no reason not to provide the majority of your donors with donation receipts. Most donation software can send automated thank-you emails that double as donation receipts for online gifts. For donations received through non-digital means, your organization will need to devise a system for sending receipts manually via email or direct mail. For in-person or mailed cash donations, many organizations set a threshold amount (commonly around $20) above which they’ll provide written receipts to donors.

Fundraising Legal Requirements Regarding Tax Exemption

The primary purpose of receiving 501(c) status from the IRS is to be recognized as a tax-exempt organization by the federal government. While a broad range of organizations can be exempted from federal taxes, the vast majority of nonprofit organizations fall under the 501(c)(3) determination. This group includes public charities or private foundations whose stated missions revolve around one of these specific charitable purposes. Any profits generated by tax-exempt organizations must be reinvested or allocated towards their stated charitable purposes, and these organizations are also restricted from most forms of political and lobbying activities.

To receive tax-exempt status, a nonprofit must complete the application process, which can be broken down into these core steps:

- File articles of incorporation with your state government.

- Receive an Employer Identification Number (EIN).

- Determine exactly what type of 501(c) organization you’re starting—public charity, private foundation, or other tax-exempt organization.

- Prepare your organization’s bylaws, mission statement, initial programming, and governance structures.

- Complete IRS Form 1023 or Form 1023-EZ within 27 months of incorporating your organization and receiving an EIN.

- Check for any additional state-specific tax exemption requirements and register to solicit donations in relevant states.

- Wait for approval and comply with all applicable tax regulations in the meantime—the IRS has specific policies in place for nonprofits in this situation.

Once approved, your organization should receive an IRS Letter of Determination certifying your tax-exempt, 501(c)(3) status. You’ll need to reference and reuse this document in a number of different contexts, most notably when registering to solicit donations in states that require it.

To maintain tax exemption, the majority of nonprofits will need to complete and submit IRS Form 990 or one of its variants each year. These publicly accessible documents give the IRS visibility into your nonprofit’s general financial activities. In them, you provide a description of your mission and purpose, top-level financial data from the past year, and your organization’s recent accomplishments. Failing to file your Form 990 on time or request an extension can result in hefty fines and potentially a loss of 501(c)(3) status, so it’s among the most important fundraising legal requirements to keep in mind. Labyrinth’s sister firm, Urich CPAs LLC, can handle all aspects of your Form 990 preparation to ensure complete compliance year after year.

Unrelated Business Income Taxes (UBIT)

Even with officially recognized 501(c)(3) status from the IRS, there are still some types of taxes that your nonprofit will need to pay. Unrelated business income taxes (UBIT) are levied on any revenue generated through activities that do not relate to your stated tax-exempt purposes. The IRS specifies that UBIT must be paid on revenue generated through activities that meet these three criteria:

- The activity is a trade or business.

- The activity is regularly carried on.

- The activity is not substantially related to the stated, tax-exempt purpose of your organization.

Examples of activities subject to UBIT might include selling parking at your facility during unrelated events happening nearby or renting out space in your building to defray mortgage costs.

If any revenue that your nonprofit generates meets the IRS’s criteria, you’ll need to report it and pay UBIT appropriately, regardless of how that revenue was later allocated. There are a handful of UBIT exceptions to remember, though. Money raised through the sale of donated property, unpaid volunteer work, and convenience initiatives (for example, a school raising money for its cafeteria services) are common exceptions that don’t require your nonprofit to pay unrelated business income taxes.

It’s always important to keep accurate, ongoing financial records for your nonprofit, but especially so when it comes to UBIT compliance. If your nonprofit generates more than $1,000 in gross income from unrelated business activities, you’ll need to file Form 990-T in addition to your regular Form 990.

Tax Exemption at the State Level

In most states, your nonprofit is automatically exempted from state income taxes once you receive official 501(c)(3) determination from the IRS. However, the regulatory landscape is quite diverse at the state level. Here are the top takeaways to remember:

- In states that automatically grant income tax exemption, you’ll often be required to provide relevant documentation during the charitable solicitation registration process in order to prove your 501(c)(3) status. These documents may include copies of your Form 990, IRS Letter of Determination, and any audited financial statements that the state requests.

- In states that don’t automatically grant income tax exemption, you’ll need to file for exemption with the relevant state Department of Revenue separately. Some of these states also require periodic renewal and may handle or classify exemptions in different ways. Always do your research or consult with compliance experts if you’re unsure about your exact requirements.

- Unrelated business income taxes must be paid at the federal level and in most states. However, states may define unrelated business income in a variety of ways, so double-check with your CPA or the relevant state agency if you’re unsure of which revenue-generating activities need to be reported.

- Nonprofits must pay and charge sales taxes in most US states. Some states do allow special exemptions on sales taxes, so check the requirements in the jurisdictions where your organization operates. However, these exemptions are not automatic and must be applied for separately.

State-level tax compliance can be more complex to navigate than the more straightforward federal exemption requirements. Consult with nonprofit CPAs, attorneys, or other compliance experts whenever you’re unsure of the particular tax requirements that apply to your organization.

Nonprofit Legal Requirements for Fundraising Events

Fundraising events are an important part of the strategies of many nonprofit organizations. They’re extremely valuable for generating donations, engaging donors, and raising your visibility in the community. However, fundraising events can open up a variety of new compliance questions that your nonprofit must consider.

The majority of these regulations apply to fundraising events that involve gambling-like “games of chance,” although there are other logistical considerations that may come into play, as well. Here are a few common event-related requirements to remember:

- Capacity guidelines. In the wake of the COVID-19 pandemic, some jurisdictions have established capacity requirements for different types of organizations and venues. If pandemic-related guidelines are currently in place where your nonprofit plans to host an event, always double-check them early in the planning process (and offer virtual-friendly components, too).

- Alcohol licenses. If you plan to serve alcohol during an in-person event, you may need a separate alcohol license depending on the state’s and/or municipality’s specific regulations.

- Games of chance licenses. Currently, 41 states and the District of Columbia require licenses for games of chance, like raffles, charity auctions, and casino nights. Look up the specific requirements for your jurisdiction before planning your fundraising event. Proceeds from games of chance may be required to be saved in a special type of bank account in some states. Nonprofits can also be required to pay gaming excise taxes on revenue generated through certain types of lotteries or contests.

Additionally, remember that donors’ contributions during auctions, raffles, and other games of chance are not tax-deductible. Refer to this IRS explainer for a complete breakdown of federal-level regulations for these types of fundraising events. At the state and municipal level, it’s your organization’s responsibility to research the relevant requirements and obtain licenses as needed. Understanding these regulations far in advance will ensure you plan a fully compliant event and avoid wasting time and resources on events that aren’t legally feasible.

Fundraising Laws Regarding Email

Email is one of the most convenient and efficient ways to connect with donors today. However, regulations around the use of email (and broader data and donor privacy concerns) have major ramifications for how nonprofits can and cannot use this tool to solicit donations.

There are three main pieces of legislation that your organization must keep in mind when engaging with donors through email:

- The CAN-SPAM Act. This 2003 US law protects consumers from receiving emails that they never agreed to receive. Although it’s targeted primarily to commercial email, nonprofits are not exempt. Any emails that promote products or involve corporate sponsors should definitely comply with it, but complete compliance is still highly recommended. CAN-SPAM requires that you verify email subscribers have “opted in” before you can email them. These opt-ins can take two forms: express permission (in which a donor gives you their email address specifically to receive communications from you) and implied permission (in which you collect email addresses during a transaction, like an online donation). For cases of express permission, you’re free to email that donor however needed. For implied permission, you should clearly state during the transaction that you may send additional emails in the future. In both cases, you need to give email recipients a clear opt-out option on all of your messages. Learn more about how CAN-SPAM can affect your email strategies with this breakdown from Bloomerang.

- The EU’s General Data Protection Regulations (GDPR). Although these digital security and privacy laws were enacted in the European Union, they can still impact how your US-based nonprofit uses email to engage with donors. The GDPR is intended to protect the personal data of EU citizens. Since nonprofits collect personal data in all kinds of ways online, these rules will apply to your nonprofit if EU citizens give you donations, interact with your website, or subscribe to receive your emails. The safest choice is to err on the side of caution and take steps to ensure GDPR compliance on your website and in your email strategies.

- The California Consumer Privacy Act (CCPA). This 2018 California state law is similar to the GDPR and sets comparable guidelines around how personal data can be collected and used. Even if your nonprofit does not operate in California, remember that this state has an extremely large population—your organization likely already engages with California residents on a regular basis if you fundraise nationwide. This act is targeted primarily at large, for-profit companies that generate revenue through selling personal data, so nonprofits are technically exempt. However, if you use any data marketing sources or other third-party vendors that do fall under the CCPA’s guidelines, due diligence requires asking about and double-checking their compliance.

Email has quickly become one of the most common fundraising methods for nonprofit organizations of all sizes. However, the constantly evolving state of digital privacy regulation means that nonprofits can’t simply use email and their donors’ personal data however they see fit. These three pieces of legislation are currently the farthest-reaching and most important to keep in mind, but stay on top of developments in the field. Consulting with nonprofit attorneys and web compliance experts will be your best bet if you’re ever unsure about exactly how regulations affect your nonprofit’s online fundraising and marketing strategies.

Wrapping Up

The world of fundraising legal requirements is complex and extremely diverse. It can certainly be a challenge to navigate it on your own, which is why the help of professional CPAs, attorneys, and compliance experts can be so beneficial for growing nonprofit organizations. However, starting with the essentials like the ones outlined in this guide is the first step towards understanding the exact requirements that your organization needs to adhere to.

And remember, the potential penalties and risks (to both your bottom line and reputation) of being non-compliant simply aren’t worth the time saved in the short run by neglecting or forgetting any of the elements discussed above.

The experts here at Labyrinth have helped countless nonprofits navigate a wide variety of compliance questions at both the federal and state levels. We can conduct the research, file the paperwork, and serve as your liaison so that your nonprofit can devote its time and attention to its mission, not on the logistical details of compliance. To keep learning about nonprofit legal requirements, we recommend these additional resources:

- Charitable Solicitation Registration: A Compliance Guide. Even after receiving federal recognition, your nonprofit must register to actively fundraise in US states. This guide walks through all the essentials of the registration process.

- Nonprofit Regulations and Requirements Directory. Looking for more detailed information on specific aspects of nonprofit compliance? We’ve gathered resources on a wide variety of regulatory contexts that nonprofits need to be aware of.

- Nonprofit Compliance Checklist. This resource compiles all of the most important nonprofit compliance guidelines that your organization may need. Bookmark it for future reference!